The main purpose of this ongoing blog will be to track planetary extreme, or record temperatures related to climate change. Any reports I see of ETs will be listed below the main topic of the day. I’ll refer to extreme or record temperatures as ETs (not extraterrestrials).😉

Main Topic: ‘Huge’- 1,600+ Institutions Have Now Divested from Fossil Fuels

Dear Diary. Let’s start out this week with some good news for a change. Big institutions want to have good public reputations, and some just want to do the right thing for society; therefore, many universities and other institutions are divesting from fossil fuel companies from their investment portfolios. You as an individual can help here too. If you are an trying to save for retirement, please check your 401K to make sure that fossil fuel companies are not in your investment mix. If you can, divest from these companies. If not, ask your employer about that. Also, do your research by supporting institutions that have recently divested from fossil fuels.

Here are more details from Common Dreams:

A divestment message is shared on the Climate Clock in Union Square in New York City in June 2023.(Photo: Climate Clock Union Square

‘Huge’: 1,600+ Institutions Holding $41 Trillion in Assets Have Now Divested From Fossil Fuels

The milestone, one campaigner said, should “give hope to folks that we are making an impact.”

Dec 15, 2023

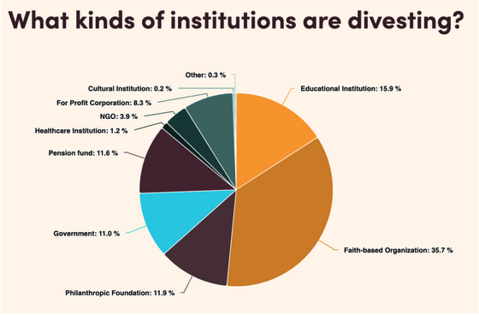

More than 1,600 institutions like universities, pension funds, and governments that hold more than $40.6 trillion in assets have now divested from fossil fuels, the Global Fossil Fuel Divestment Movement announced Friday.

The announcement comes days after the 28th United Nations Climate Change Conference wrapped with a call for “transitioning away from fossil fuels” but stopped short of agreeing to the stronger “phaseout” of oil, gas, and coal backed by climate advocates and frontline communities.

“This number is huge,” Amy Gray, Stand.earth climate finance associate director and coordinator of the Climate Safe Pensions Network, told Common Dreams. To put it in perspective, $40.6 trillion is equal to a little less than half of global gross domestic product.

The scale of the divestments to date, said Gray, “should show and give hope to folks that we are making an impact and we are making a difference and changing things for the better, regardless of these elitist events where the everyday person and the folks in the Global South and other places are discounted.”

A Decade of Divestment

Friday’s update to the Global Fossil Fuel Divestment Commitments Database reflects around a decade of organizing, Gray said. Organizers at 350.org started tracking divestment commitments when Gray and current Stand.earth climate finance director Richard Brooks worked there. When the pair moved to launch a climate finance team at Stand.earth, they brought the database with them.

While the divestment movement has seen ups and downs over that decade, Gray said it had picked up momentum over the last five or six years. In less than two years, the number of institutions divesting jumped by 120, holding a combined $1.4 trillion in assets.

“We’ve definitely seen a massive increase in divestment commitments as the divestment movement has built itself out and gotten stronger,” Gray said.

“This milestone follows years of attempted shareholder engagement, now a proven futile strategy, with fossil fuel corporations hell-bent on our destruction.”

Notable victories in 2023 included PMT, the largest private pension in the Netherlands; New York University, the National Academy of Medicine, and the Church of England.

The Church of England divestment was especially notable, Gray said, because of the statement that accompanied it. The church emphasized that it had tried to engage with the oil and gas companies it was invested in and urged them to adopt policies in line with the Paris agreement, but the companies did not change.

“The decision to disinvest was not taken lightly,” Alan Smith, first church estates commissioner, said at the time. “Soberingly, the energy majors have not listened to significant voices in the societies and markets they serve and are not moving quickly enough on the transition. If any of these energy companies come into alignment with our criteria in the future, we would reconsider our position. Indeed, that is something we would hope for.”

Gray remembered thinking at the time that it was the best divestment statement she’d ever read.

“It was really powerful,” she said.

The Church of England wasn’t the only institution that thought it could persuade Big Oil to change its ways without divesting.

“This milestone follows years of attempted shareholder engagement, now a proven futile strategy, with fossil fuel corporations hell-bent on our destruction,” Brooks said in a statement. “Instead of financing climate chaos-causing fossil fuels, violence, and extraction, financial institutions like big banks and pension funds must protect people and planet alike, cutting ties with fossil fuels and reinvesting in proven community-led climate-safe solutions.”

People vs. Fossil Fuels

The success of the divestment movement has been driven by “people power, 100%,” Gray said.

This includes larger organizations like Stand.earth or the Sierra Club and big-name activists like Bill McKibben or former New York Comptroller Tom Sanzillo, but ultimately comes down to smaller grassroots efforts.

“It’s the little group in Wisconsin that’s working on divesting their pension fund,” Gray said. “It’s a small group in the Bay Area who is pressuring Citi or one of the big banks, and it’s the kids at the colleges.”

“Oil companies are finding it increasingly difficult to raise financing amid rising ESG and sustainability concerns.”

There’s evidence that all this activism is making a difference for the industry. The “cost of capital” for funding new fossil fuel projects has risen steeply in the last decade, from 8% to 10% to around 20% as of 2021, according to Bloomberg.

During the same time, the cost for financing renewables has dropped from that same 8% to 10% to between 3% and 5%.

Bloomberg Intelligence analyst Will Hares laid the divergence at the feet of the push for environmental and social governance (ESG) in investing.

“Oil companies are finding it increasingly difficult to raise financing amid rising ESG and sustainability concerns, while banks are under pressure from their own investors to reduce or eliminate fossil-fuel financing,” Hares said.

Gray also added that Indigenous-led movements such as the Wet’suwet’en struggle against the Coastal GasLink pipeline in Canada have had a material impact on the industry.

The pipeline’s costs have more than doubled during that time from an estimated $6.6 billion to $14.5 billion, CBC News reported this month.

At the same time, divesting from fossil fuels is actually a financial win for pension funds and other institutions: A study released this year by the University of Waterloo found that six U.S. pension funds would actually be $21 billion richer today if they had quit fossil fuels 10 years ago.

The Next 1,600

In the context of a disappointing outcome at COP28, President Joe Biden’s greenlighting of drilling projects, and the specter of a second Trump presidency, the success of the divestment movement offers hope that climate campaigners can shift the world away from fossil fuels without needing to rely on international agreements or national legislation.

“It’s not necessary to enact the change we need to see,” Gray said. “We can change these systems of oppression from within.”

Looking ahead to 2024, Gray thinks there’s a good chance that California will finally pass legislation to divest its two pension funds, CalPERS and CalSTRS, from fossil fuels. The two funds, the largest public pensions in the country, control a total of $685 billion, including more than $42 billion in fossil fuels.

“Even the person with the smallest amount of investments can get involved.”

If California does pass the legislation, it will “cause a massive ripple effect,” Gray said.

“If we’re able to divest the two largest pension funds in the country, there’s nothing we can’t divest.”

Another thing Gray expects to see is more coordination between the efforts to divest from both fossil fuels and the weapons industry, as more and more people react with shock watching U.S.-made and -funded arms devastating the people of Gaza.

“War is a climate issue,” Gray said.

For people not yet involved in the divestment movement, Gray recommends signing up for email updates from Stand.earth or the Climate Safe Pensions Network and looking up local climate groups and going to a meeting.

“Even the person with the smallest amount of investments can get involved,” Gray said. “Anybody can join the climate movement, and we’re always ready to help folks take that step.”

Here are more “ET’s” recorded from around the planet the last couple of days, their consequences, and some extreme temperature outlooks, as well as any extreme precipitation reports:

Another scorching hot night in South America, it's the 6th in a row where MIN. temperatures >30C were recorded

— Extreme Temperatures Around The World (@extremetemps) December 18, 2023

In Argentina Tmin 30.4C at Presidencia Roque Saenz Pena,a record for December and 0.1C from all time high

In Paraguay more minimums >30C

It 'll start cooling later today https://t.co/8jh9Hr8VsK

[1] SOUTH AMERICA between record heat and catastrophic floods

— Extreme Temperatures Around The World (@extremetemps) December 18, 2023

Historic heat in BRAZIL

30.5C MINIMUM TEMP at Cuiaba HIGHEST DECEMBER MIN. IN BRAZIL HISTORY

Dozens of monthly records of highest Tmins/Tmaxes fell

Highest was 41.9 Tres Lagoas https://t.co/LbHEqJckad

Insane heat in THAILAND

— Extreme Temperatures Around The World (@extremetemps) December 17, 2023

December National record again with 38.5C at Laem Chabang

MINIMUM temperatures up to 28.5C at Bangkok Pilot

Records also at

36.5C Ko Sichang

36.0C Phuket

Bangkok hasn't dropped below 26C in the whole month so far.

This should be the "cold season"… pic.twitter.com/nWXRvPP447

79 inches of rain in 5 days? More than a foot of rain/day over Queensland, #Australia https://t.co/6MzFKeqYYy

— Laurie Garrett (@Laurie_Garrett) December 18, 2023

Incredible deluges continue in Queensland, AUSTRALIA:

— Extreme Temperatures Around The World (@extremetemps) December 18, 2023

Bairds recorded an astonishing 870mm of rainfall in 24 hours which would be the highest ever recorded in Australia in December and 3rd overall.

Details 👎 https://t.co/yTb7DiiB0X

Extreme rainfalls and deluges in SE India specially in Tamil Nadu State.

— Extreme Temperatures Around The World (@extremetemps) December 18, 2023

An astonishing amount of 946mm of rain in 24 hours was recorded at Kayalpattinam. https://t.co/BLqQGqv34o

Here is More November and December 2023 Climatology:

November 2023 in #India had an average temperature of 24.27C which is +1.05C above the 1981-2010 norm and was WARMEST NOVEMBER ON RECORD.

— Extreme Temperatures Around The World (@extremetemps) December 18, 2023

It was especially warm in the East and South.

See graph and map courtesy of IMD. pic.twitter.com/khFkme40y7

November 2023 in #Malaysia had an average temperature of 28.15C and was the warmest November on record (after the warmest October).

— Extreme Temperatures Around The World (@extremetemps) December 18, 2023

Southern and NE of the Peninsula were very rainy,normal amounts prevailed in the rest of the country.

See rainfall anomalies map by Meteo Malaysia. pic.twitter.com/05pZcF8KcQ

November 2023 in #Russia was warmer than normal in most of the country up to +2C/+4C from Caucasus to Siberia.

— Extreme Temperatures Around The World (@extremetemps) December 18, 2023

In Moscow it was +1.2C warmer than average.

Autumn 2023 as a whole was the second warmest on record after 2020.

See November anomalies map by Meteoinfo Russia. pic.twitter.com/c44t0qyc6c

Congratulations, the entire Lower 48 now has a month-to-date average temperature above the 1991-2020 normal – which is warmer that previous normal periods. 🔥 pic.twitter.com/tuaEIj7nXZ

— Brian Brettschneider (@Climatologist49) December 18, 2023

Here is More Climate and News from Monday:

(As usual, this will be a fluid post in which more information gets added during the day as it crosses my radar, crediting all who have put it on-line. Items will be archived on this site for posterity. In most instances click on the pictures of each tweet to see each article. The most noteworthy items will be listed first.)

With the November update in HadCRUT5, the global warming trend from all possible start dates to the present has become positive.

— Mika Rantanen (@mikarantane) December 18, 2023

So even if you start the trend from the 2016 Super El Niño, it's no longer possible to get negative trends.

No warming in 8 years anyone? https://t.co/XKjCx965xX pic.twitter.com/fcEpvC25Mc

Australia a years rain fell in just 24 hours

— GO GREEN (@ECOWARRIORSS) December 18, 2023

Similar floods in South Carolina and in parts of India

As temperatures in Spain in Malaga saw temperatures hit 29.9C (85.82) in Winter

Our world is rapid changing

As billionaires spend billions building underground bunkers https://t.co/6G0IrdAYfH

Why is 2023 so F*cking hot?

— Leon Simons (@LeonSimons8) December 18, 2023

Because our planet is now absorbing 2.2 W/m² more heat from the sun than it did the first decade of this century.

And because the extra greenhouse gases keep most of that additional heat on Earth.

This is the most important graph in the world: pic.twitter.com/CX8g611rXz

All latitude bands observed above average temperatures during the last three months…

— Zack Labe (@ZLabe) December 18, 2023

[Plot shows zonal-mean surface air temperature anomalies (1951-1980 baseline), where latitude = x-axis (not scaled by distance). Data from GISTEMPv4] pic.twitter.com/v4pK8NPcnk

Climate groups begin legal actions against Rosebank North Sea oil project https://t.co/dnOqwt7OY4

— Guardian Environment (@guardianeco) December 18, 2023

Climate change.

— Dr Paul Dorfman (@dorfman_p) December 18, 2023

Sea-level rise driven storm surge is near-term risk to coastal nuclear reactors. #climate #ClimateCrisis #nuclear https://t.co/h1abaaY7SY pic.twitter.com/eHChlNDqU9

On #MigrantsDay, look back at this year's Climate Litigation Report which predicts a rise in cases dealing with climate migration, including cases brought by those disproportionately affected by the climate crisis & extreme weather events. #YearInReview https://t.co/DxEuj3kev1 pic.twitter.com/kvqS2EuhIk

— UN Environment Programme (@UNEP) December 18, 2023

Reconstructing November #Arctic sea ice extent since 1850…

— Zack Labe (@ZLabe) December 18, 2023

Find out more about this data by reading: https://t.co/7q9EnNgpQa pic.twitter.com/PjACDMMP3D

Global sea surface temperatures are nearing record anomaly territory (again), and are back over 5 sigma above the 1982-2011 mean (first 30 years of data).

— Prof. Eliot Jacobson (@EliotJacobson) December 18, 2023

Will a new record be set in 2023? The magic 8-ball says "f&%kery ahead!" pic.twitter.com/m0ZjGRvWRk

And yet, every day, barges full of coal from Australian mines float out over the rapidly dying Great Barrier Reef, headed to distant power plants that heat up the atmosphere and bring home Biblical rains and flooding and bushfires and heatwaves. https://t.co/PiFxvqqP3Z

— Jeff Goodell (@jeffgoodell) December 18, 2023

The #ClimateEmergency comes down to plutocrats vs life on earth. https://t.co/agoQjFRsf5

— Sophie Gabrielle (@CodeRedEarth) December 17, 2023

"the global food system may not be far from its tipping point, for structural reasons similar to those that tanked the financial sector in 2008." pic.twitter.com/a1KQkCbPSo

As the year draws to a close, we extend our heartfelt thanks to our Geneva and worldwide colleagues dedicated to #Working4TheWorld. Their commitment underlines the essential role of international cooperation in advancing #ClimateAction.https://t.co/NMw3tVNlwe pic.twitter.com/I8zEZq2PRt

— World Meteorological Organization (@WMO) December 18, 2023

Maybe because it is true. https://t.co/pErHRnGohH @ScientistRebel1 pic.twitter.com/g9MYjvPdlM

— Dr. William J. Ripple (@WilliamJRipple) December 18, 2023

Today’s News on Sustainable Energy, Traditional Polluting Energy from Fossil Fuel, and the Green Revolution:

Stopping new LNG Exports has quickly emerged as the key test for Biden’s commitment to the pledge coming out of #COP28 to transition away from fossil fuels. @billmckibben talks with @AliVelshi about how the White House can make the right call. https://t.co/N9fBH1FZtg

— Jamie Henn (@jamieclimate) December 17, 2023

In today’s @latimes: My column calling on Gov. Gavin Newsom to stop standing by while his appointees crash the rooftop solar market and start going to bat for a crucial clean energy solution: https://t.co/CboAGPdjRs pic.twitter.com/07Chy6Biwa

— Sammy Roth (@Sammy_Roth) December 18, 2023

More from the Weather Department:

Tough to see. Mangled metal. This is on I-94. Please be extremely careful with travel around the Great Lakes/OH Valley today. Snow squalls will drop visibility and create dangerous travel with sudden rapid changes. https://t.co/WfcRVbFHx1

— Jacqui Jeras (@JacquiJerasTV) December 18, 2023

Southern India.

— Laurie Garrett (@Laurie_Garrett) December 18, 2023

2023 is determined to end with final moments of #ClimateEmergency — lest anybody forget that out world is firmly set on the wrong trajectory. https://t.co/vfdKOKq7iW

Charleston and the South Carolina coast were hit by record rain and saw historic flooding this weekend as a powerful storm made its way up the East Coast. pic.twitter.com/1oqCaFiw6J

— AccuWeather (@accuweather) December 18, 2023

Lots of power all rapped into one eastern tough and coastal low pressure. pic.twitter.com/eJXegjfV7U

— Jim Cantore (@JimCantore) December 18, 2023

Power outages are climbing this Monday AM for the NE. Heavy rains combined with big Atlantic winds causing… all from the Gulf low still skirting the east coast. https://t.co/Hk3pbO7x8H pic.twitter.com/9AP3Nqkyif

— Mike's Weather Page (@tropicalupdate) December 18, 2023

Quick synoptic analysis – today's cyclone is a neat case of how extratropical lows can be quite broad, in this case forcing for ascent from differential cyclonic vorticity advection in the right-entrance quadrant of a jet becomes increasingly detached from the initial SE US low: pic.twitter.com/nsuLjppkEA

— Tomer Burg (@burgwx) December 18, 2023

Check out this video of strong winds due to a brief tornado yesterday that lashed through Carolina Forest, SC!

— WeatherNation (@WeatherNation) December 18, 2023

The tornado reportedly had winds up to 100 mph winds! pic.twitter.com/hEUp4VFGh1

#Snow cover tells tale of two continents. Eurasia approaching decadal highs in extent while North America is at decadal lows. Strong push of snow cover across China while the US is the biggest laggard. pic.twitter.com/TVXPUdzZXf

— Judah Cohen (@judah47) December 18, 2023

POWERHOUSE PATTERN SETTING UP IN 2024

— Mike Masco (@MikeMasco) December 18, 2023

This pattern evolution will really be seen in the next 15-20 days as the #ArcticOscillation tanks negative and the pacific (EPO) switches negative as well (a deep trough establishes NE of #Hawaii.

The biggest feature I see in the long range… pic.twitter.com/gKexdTayLS

Long-advertised pattern change has finally arrived in CA, w/waves of mod-heavy showers & isolated t-storms occurring over NorCal as cut-off low taps into subtropical moisture. In fact, between this system & next, it'll be raining more often than not across for next 4 days! #CAwx pic.twitter.com/a8Mihm613H

— Dr. Daniel Swain (@Weather_West) December 17, 2023

What are your chances for a white Christmas?

— NOAA (@NOAA) December 18, 2023

Find places that have the best chance of snowfall, according to the historical record:https://t.co/X7TsELjST3 pic.twitter.com/WmG7wNbszc

More on the Environment and Nature:

These irreplaceable old growth forests continue to be logged across British Columbia. Over 1,200 people have been arrested trying to keep them standing.

— Mike Hudema (@MikeHudema) December 18, 2023

There is no time to waste. Protect the Irreplaceable. #ActOnClimate #climate #nature @bcndp #bcpoli #bcgov Pic @TJWattPhoto pic.twitter.com/R6X5j3dWZ9

Last year saw a historic moment: Countries agreed to take action for our shared home👏🌱

— WWF (@WWF) December 18, 2023

Together, they committed to halt & reverse nature loss by 2030.

This is vital for people & the planet. A year on, how is your country acting for a #NaturePositive world? #AgreementToAction pic.twitter.com/9rKuzEneem

More on Other Science and the Beauty of Earth and this Universe:

Absolutely incredible #AuroraBorealis activity overnight during the geomagnetic storm. #NOAA20 captured this 0741 UTC scene via the VIIRS Day Night Band sensor. https://t.co/N94utqlp7f pic.twitter.com/lzGGDeEvZO

— UW-Madison CIMSS (@UWCIMSS) December 18, 2023

Night Thoughts

— Green is a mission (@Greenisamissio1) December 18, 2023

Giants❤️ that take your breath away and you suddenly feel so small.🌳🌲💚

Such witnesses of time must be protected.

Photo: A. Braiden pic.twitter.com/VMC8G4pWfz