Friday October 18th… Dear Diary. The main purpose of this ongoing blog will be to track United States extreme or record temperatures related to climate change. Any reports I see of ETs will be listed below at the very end of this daily blog. I’ll refer to extreme or record temperatures as ETs (not extraterrestrials).😉

Money Talks To The Tune Of $713 Billion…What Investment Banks Are Doing To Prop Up Big Oil

I had the very distinct pleasure of meeting one of my media idols, Rachel Maddow, this past weekend during Atlanta Gay Pride festivities for her Blowout book tour at the Fox Theater. She is one of the brightest people that I know, having a sparkling dry wit for humor. Dr. Maddow signed my copy of Blowout, which entails just how badly big oil money and corruption have become entangled with worldwide economies. I gave her a signed copy of my climate primer for young kids: World of Thermo…Thermometer Rising. Hey, for proof here is a picture of her and the old Climate Guy in his wheelchair:

(Also pictured behind us is my cousin Marsha, who helped create an environmental documentary for PBS entitled This American Land. Check that out: https://www.thisamericanland.org/)

For the last thirty years I have been just skimming the surface of what big oil has done to politics involving oil and associated bad business, just reading mostly about climate change and its effects and doing my own climate related science. What really lies underneath that surface is quite the behemoth of a true monster I was not very much aware of. The belly of the beast is enormous and full of all sorts of rotten practices and people. I highly recommend Rachel Maddow’s Blowout, which is already #1 on the New York Times best seller list, to all of my readers, but check your blood pressure before picking up this exceptionally well written 400 page tome. If you are involved with the climate issue you will get extremely steamed just a couple of chapters in.

Today I saw another article posted by Desdemona Despair that is very much in keeping with Blowout and will leave my readers aghast. Apparently investment bankers have spent near three quarters of a trillion dollars just since the Paris Accords were ratified in 2015 to prop up big oil. Brace yourself here:

Top investment banks provide $713 billion to expand fossil fuel industry since Paris climate change agreement – “We can all sit around pointing fingers at each other, but that doesn’t help solve what is a really complex and multifaceted problem”

Aerial view of the Jonah Field gasfields in Wyoming, U.S. Photo: Simon Fraser University

By Patrick Greenfield

13 October 2019

(The Guardian) – The world’s largest investment banks have provided more than $700 billion of financing for the fossil fuel companies most aggressively expanding in new coal, oil and gas projects since the Paris climate change agreement, figures show.

The financing has been led by the Wall Street giant JPMorgan Chase, which has provided $75bn (£61bn) to companies expanding in sectors such as fracking and Arctic oil and gas exploration, according to the analysis.

The New York bank is one of 33 powerful financial institutions to have provided an estimated total of $1.9 trillion to the fossil fuel sector between 2016 and 2018.

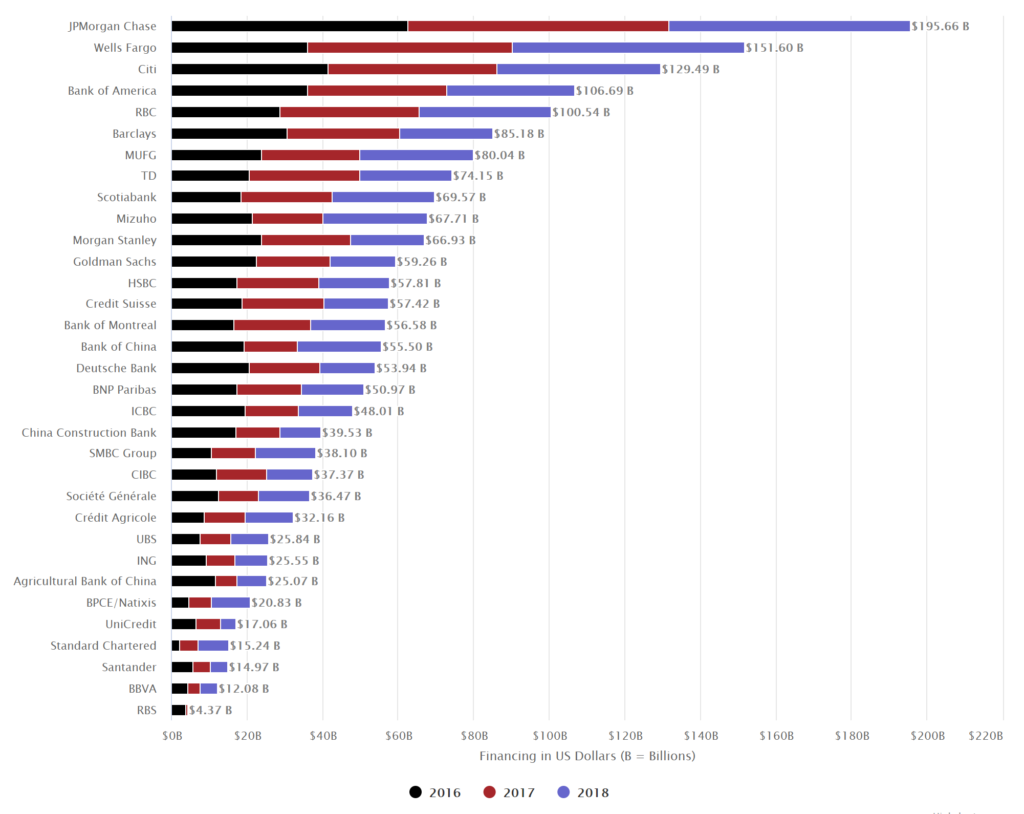

Total fossil fuel financing by investment banks in 2016, 2017, 2018, and the first half of 2019. Data: RAN. Graphic: The Guardian

The data show the most aggressively expanding coal-mining operations, oil and gas companies, fracking firms and pipeline companies have received $713.3 billion in loans, equity issuances, and debt underwriting services from 2016 to mid-2019.

Other top financiers of fossil fuel companies include Citigroup, Bank of America and Wells Fargo.

Using Bloomberg financial data and publicly available company disclosures, the analysis was compiled exclusively for the Guardian by Rainforest Action Network, a US-based environmental organisation.

A bird perches on a bird-deterrent system in a tailings pond in the Athabasca oil sands, Alberta, Canada. Photo: Bloomberg / Getty Images

The figures update the group’s Banking on Climate Change 2019 report from April, which showed the practices of key investment banks were aligned with a climate disaster.

Figures show fracking has been the focus of intense financing, with Wells Fargo, JPMorgan Chase and Bank of America providing about $80 billion over three years, much of it linked to the Permian basin in Texas.

The New York bank is one of 33 powerful financial institutions to have provided an estimated total of $1.9 trillion to the fossil fuel sector between 2016 and 2018. […]

Total fossil fuel financing by investment banks in 2016, 2017, and 2018. The financing has been led by the Wall Street giant JPMorgan Chase, which has provided $75 billion (£61 billion) to companies expanding in sectors such as fracking and Arctic oil and gas exploration. Graphic: RAN

Elsa Palanza, Barclays’ global head of sustainability and citizenship, said: “We can all sit around pointing fingers at each other, but that doesn’t help solve what is a really complex and multifaceted problem. What can help solve the problem is, firstly, the voluntary mechanisms we are working on, like the Task Force on Climate-related Financial Disclosures, and then the new attention from regulators like the PRA [Prudential Regulation Authority].

“The new requirements make people working in banks think about climate change as a double-sided coin, to look at the risks within our portfolio, but also thinking about the opportunity side in terms of financing renewable energy. That’s leveraging the best of what a bank would offer.”

The big four state-owned Chinese banks, which have no fossil fuel financing policies, have dominated services for coal miners and coal power companies since 2016. [more]

Top investment banks provide billions to expand fossil fuel industry

The only thing we can do here is continue to educate the public, and personally and as a Climate Reality member, protest protest protest. Kids of Greta Thunberg’s age will also continue to protest and eventually right the worldwide political shift, but is all this to late given what big oil gas already done the last thirty years and how powerful it is today? This is also a question that we will try to answer in the next couple of years.

Here is more climate and weather news from Friday:

(As usual, this will be a fluid post in which more information gets added during the day as it crosses my radar, crediting all who have put it on-line. Items will be archived on this site for posterity. In most instances click on the pictures of each tweet to see each article.)

(If you like these posts and my work please contribute via the PayPal widget, which has recently been added to this site. Thanks in advance for any support.)

Guy Walton- “The Climate Guy”